The Soaring Value of Intangible Assets in the S&P 500

The Briefing:

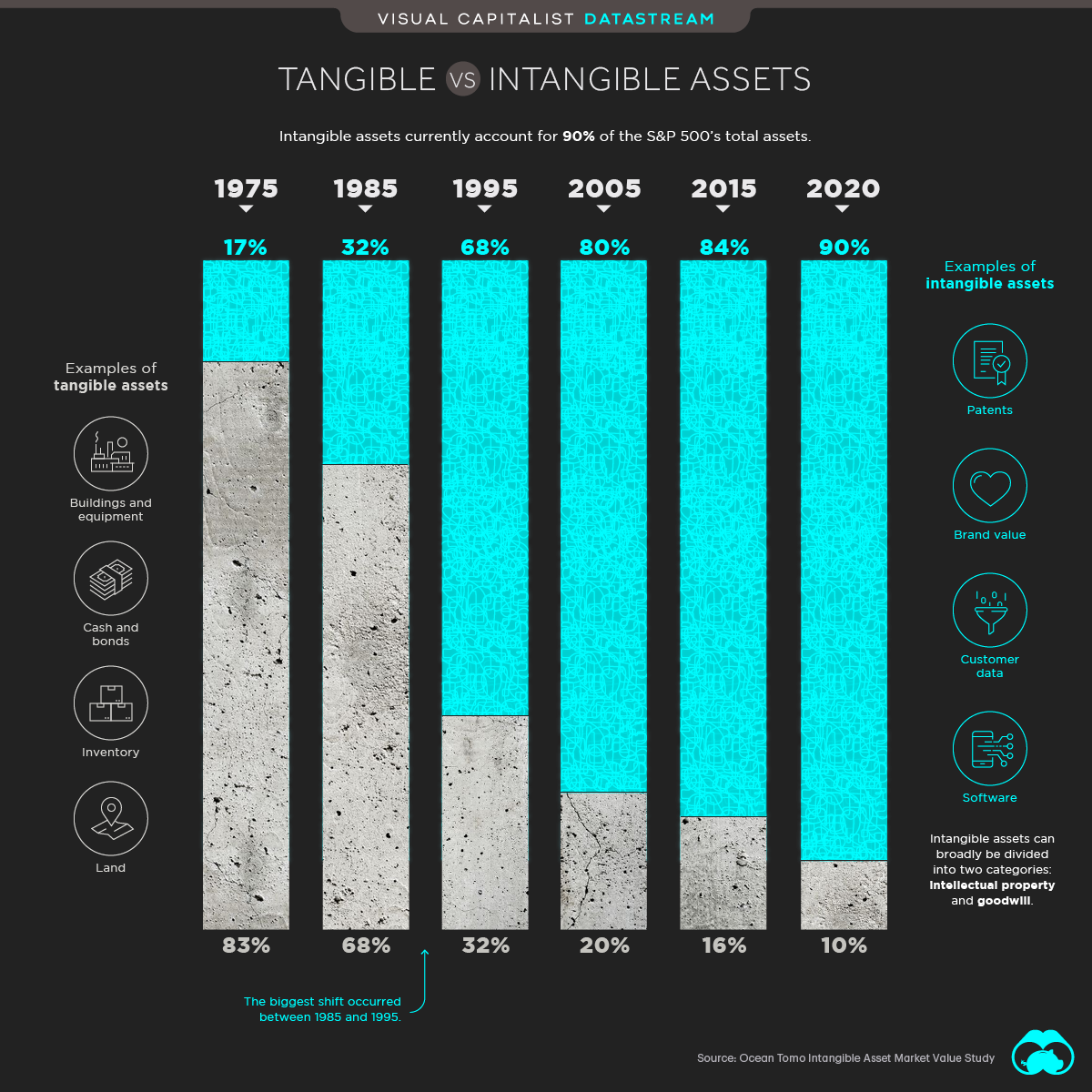

- Intangibles as a portion of total assets in the S&P 500 have reached unprecedented levels.

- As of 2020, 90% of all assets in the S&P 500 are now intangible.

When it comes to the S&P 500’s market value, abstract is in.

Intangible assets currently account for 90% of the index’s total assets. Not only is this a historical high—it’s a nod to just how prevalent technology has become in our lives.

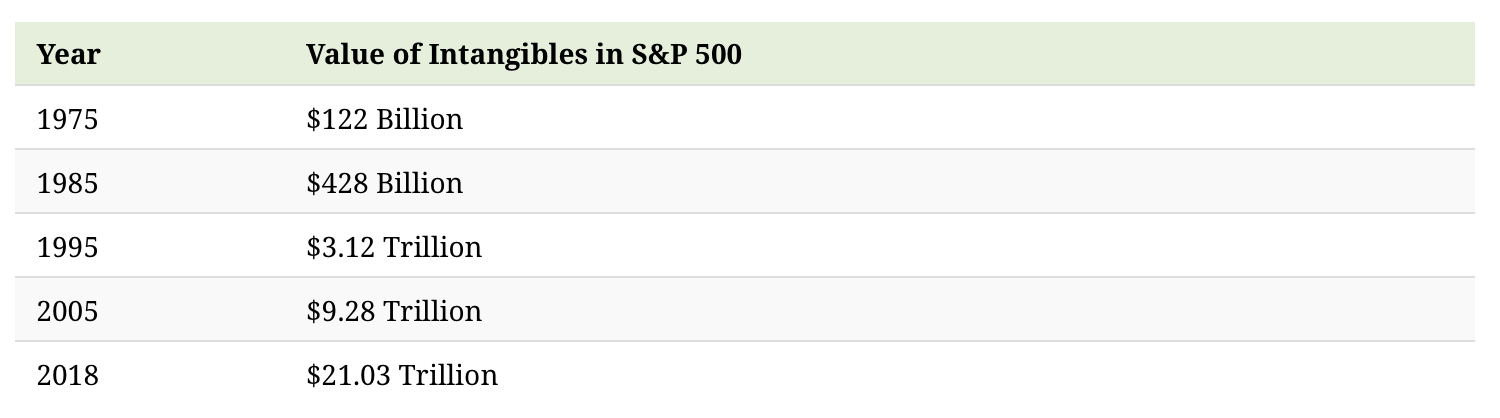

Intangible assets are holdings that don’t carry any physical or financial embodiment. This includes R&D, intellectual property, and computerized information such as data and software. While they’re often difficult to value due to certain accounting practices, today, intangibles are worth over $21 trillion.

The value of intangible assets in dollar terms has risen from $122 billion in 1975, eventually soaring past the $1 trillion mark in the coming decades.

The 1990s ushered society into an era of tech, where intangible assets first began to take majority status. The timeline was hardly linear and smooth transition, and some serious bumps took place along the way including two market crashes in 2000 and 2008.

There are reasons to suggest that influence of tech and thus intangible assets has more steam in its engine. The looming 5G revolution, more internet users on the horizon, and the powerful potential of new technologies are all supporting considerations.

Where does this data come from?

Source: Ocean Tomo Intellectual Capital Equity and IP CloseUp.

Notes: Certain accounting practices can lead to difficulties in valuing an intangible asset and at times must be estimated based on transactions or the difference between company book and market value.